VIEWS

FINANCE: Ways to Save More Tax

Recent Gauteng Business News

None of us love paying tax and with income tax filing season for individuals having opened on 1 July, here are some of the ways individuals and, in some instances, companies and trusts can reduce their income tax liability. Judy Snyman, Fiduciary Specialist at AlphaWealth which offers wealth planning services for high-net-worth individuals and families explains what to do.

Section 12J Venture Capital Companies

Consider investing in Venture Capital Companies (VCCs). Investors are entitled to deduct the full amount of their investment from their taxable income in the tax year. The tax relief is 41% for individuals and trusts and 28% for companies which significantly enhances the potential return and helps to mitigate the investment risk.

Through Section 12J Venture Capital Companies, government aims to stimulate the economy and promote investment in South African small and medium-sized businesses, whilst providing tax benefits to investors. The VCC regime is subject to a 12 year sunset clause that ends on 30 June 2021.

The tax benefits involved in investing in a VCC are:

The full amount invested in a VCC is 100% deductible from your taxable income in the year in which the investment is made. This applies to individuals, companies and trusts.

The full amount invested in a VCC is 100% deductible from your taxable income in the year in which the investment is made. This applies to individuals, companies and trusts.

investor in a VCC will therefore obtain a 41% tax break (for an individual tax payer at maximum marginal rate) at the time of investment.

investor in a VCC will therefore obtain a 41% tax break (for an individual tax payer at maximum marginal rate) at the time of investment.

the investment is held for five years there is no tax recoupment.

the investment is held for five years there is no tax recoupment.

Tax-free savings accounts

Tax-free savings accounts are a savings product introduced in South Africa in March 2015. These accounts allow you to save a maximum of R30 000 per year and R500 000 in your lifetime. You save in a specially designated fund/account without there being any tax payable on the capital gains realised or the interest or dividends received on these investments. This is different to a pension/retirement annuity where your main tax saving is on your upfront contribution.

Pension, provident funds and retirement annuities

Pension funds and retirement annuities (RAs) offer individuals considerable benefits from a tax perspective. The three main tax benefits are:

are tax deductible – you may deduct up to 27,5% of your gross remuneration or taxable income (whichever is the higher) in respect of your total contributions to a pension, provident or retirement annuity fund, subject to an annual limit of R350 000.

are tax deductible – you may deduct up to 27,5% of your gross remuneration or taxable income (whichever is the higher) in respect of your total contributions to a pension, provident or retirement annuity fund, subject to an annual limit of R350 000.

returns are tax free – there is no income tax or capital gains tax on the investment return earned in a RA.

returns are tax free – there is no income tax or capital gains tax on the investment return earned in a RA.

are taxed on a favourable basis – lump sum benefits are taxed on a sliding scale with a portion of the benefit tax free.

are taxed on a favourable basis – lump sum benefits are taxed on a sliding scale with a portion of the benefit tax free.

Donations to charities

Tax payers including companies and trusts are able to donate up to 10% of their taxable income to public benefit organisations (PBOs) and claim a tax deduction on this donation, as long as these PBOs are registered with SARS and comply with section 18A of the Income Tax Act by issuing a valid tax certificate for all donations received.

Medical aid contributions

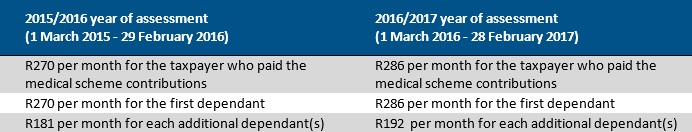

All individual taxpayers receive a monthly medical scheme contribution tax credit. For taxpayers under 65, this is as follows:

Taxpayers are also able to deduct certain qualifying out-of-pocket medical expenses incurred during the tax year.

Deductions for rental properties

There are certain expenses which you can deduct from income received from your rental property. This includes the interest portion of your mortgage bond if the property is bonded, levies, rates and taxes, insurance premiums, rental agent’s commission, repairs and maintenance costs and bank charges.

Business News Sector Tags: Finance|